In this fast-evolving landscape, concepts like yield farming, tokenized BTC, and flash loans have taken center stage. Among these, automated market maker (AMM) protocols, including Uniswap, Balancer, and Curve, have risen to prominence, delivering remarkable liquidity and user-friendliness.

What is a market maker?

A market maker helps with making it easy for traders to buy and sell assets on centralized exchanges. These exchanges handle the trading operations and use automated systems to match trading orders. In simpler terms, if someone wants to buy something at a certain price, the exchange finds someone willing to sell it at that price. The exchange acts as a go-between to make this process smooth and quick.

What are Automated Market Makers (AMMs)?

Automated market makers (AMMs) are like decentralized exchanges (DEXs) that use math formulas to set asset prices. Instead of using order books like traditional exchanges, they use formulas to determine prices. Different AMMs may use various formulas, but the common theme is that they use math to figure out prices.

How does an Automated Market Maker (AMM) work?

AMMs are similar to exchanges with trading pairs (like ETH/DAI). However, they don’t require other traders to complete a trade. Instead, they use smart contracts to make trades happen. Unlike regular exchanges where people trade directly with each other, AMMs work by trading with smart contracts, making the process highly automated.

To make AMMs work, they need liquidity providers (LPs). LPs add money to liquidity pools, creating a big source of funds for traders. In return, LPs earn fees from the trades happening in those pools.

Automated Market Maker (AMM) vs order books

Automated Market Makers (AMMs) and traditional order books are two different ways to trade cryptocurrencies.

AMMs are like automated vending machines for trading. They allow anyone with an internet connection to trade cryptocurrencies easily. They don’t rely on people making specific buy or sell orders. Instead, they use smart contracts and pools of cryptocurrency to determine the prices automatically. People who provide cryptocurrency to these pools can earn fees.

However, there is a risk of losing money if the value of the deposited cryptocurrency changes a lot. AMMs can’t automatically fix prices, so arbitrageurs are needed to balance them.

Traditional order books are like a marketplace where people place specific orders to buy or sell cryptocurrencies. These exchanges are user-friendly and offer advanced trading tools. They show a list of current buy and sell orders, and you can set your own price for buying or selling.

When the cryptocurrency’s price matches your set price, the order is executed. These exchanges usually have more trading options and higher trading volumes, making them popular for bigger cryptocurrencies like Bitcoin and Ethereum.

What do liquidity pools do?

Liquidity providers maintain liquidity pools, which are large collections of funds available for trading. For instance, in the ETH/DAI pool on Uniswap, LPs deposit equal amounts of two tokens, like 50% ETH and 50% DAI.

AMMs are inclusive, allowing almost anyone to be a market maker. Adding funds to a liquidity pool is straightforward, and LPs get rewards determined by the specific AMM protocol. For example, Uniswap v2 charges traders a 0.3% fee, which goes to LPs. Other platforms may have different fee structures to attract more liquidity providers.

Liquidity is crucial for AMMs to work well. More liquidity in a pool means less price change when making large trades. This attracts more trading, creating a beneficial cycle. However, it’s important to note that slippage, or the price change, can differ between various AMMs.

What is impermanent loss?

Impermanent loss happens when the price of tokens in a liquidity pool changes over time. The bigger the change, the more loss you might have. This is more likely when pools contain tokens with different values.

Some AMMs, like Uniswap’s ETH/DAI pool, can experience impermanent loss but still profit from trading fees. It’s essential to understand that this loss is not really “impermanent.” If you withdraw funds at a different price than when you deposited them, the losses are permanent.

Example of AMM protocols

Several notable AMM protocols are available today:

- Uniswap: A popular AMM, Uniswap focuses on open and accessible markets, using AMM to calculate token prices.

- Balancer: Similar to Uniswap, Balancer offers custom pool ratios, multi-token pools, and dynamic fees, allowing it to work as an index in the crypto domain.

- Kyber Network: One of the oldest AMM protocols, Kyber Network is managed by professional market makers, providing control over liquidity pools during volatility. However, it has restrictions on pool access.

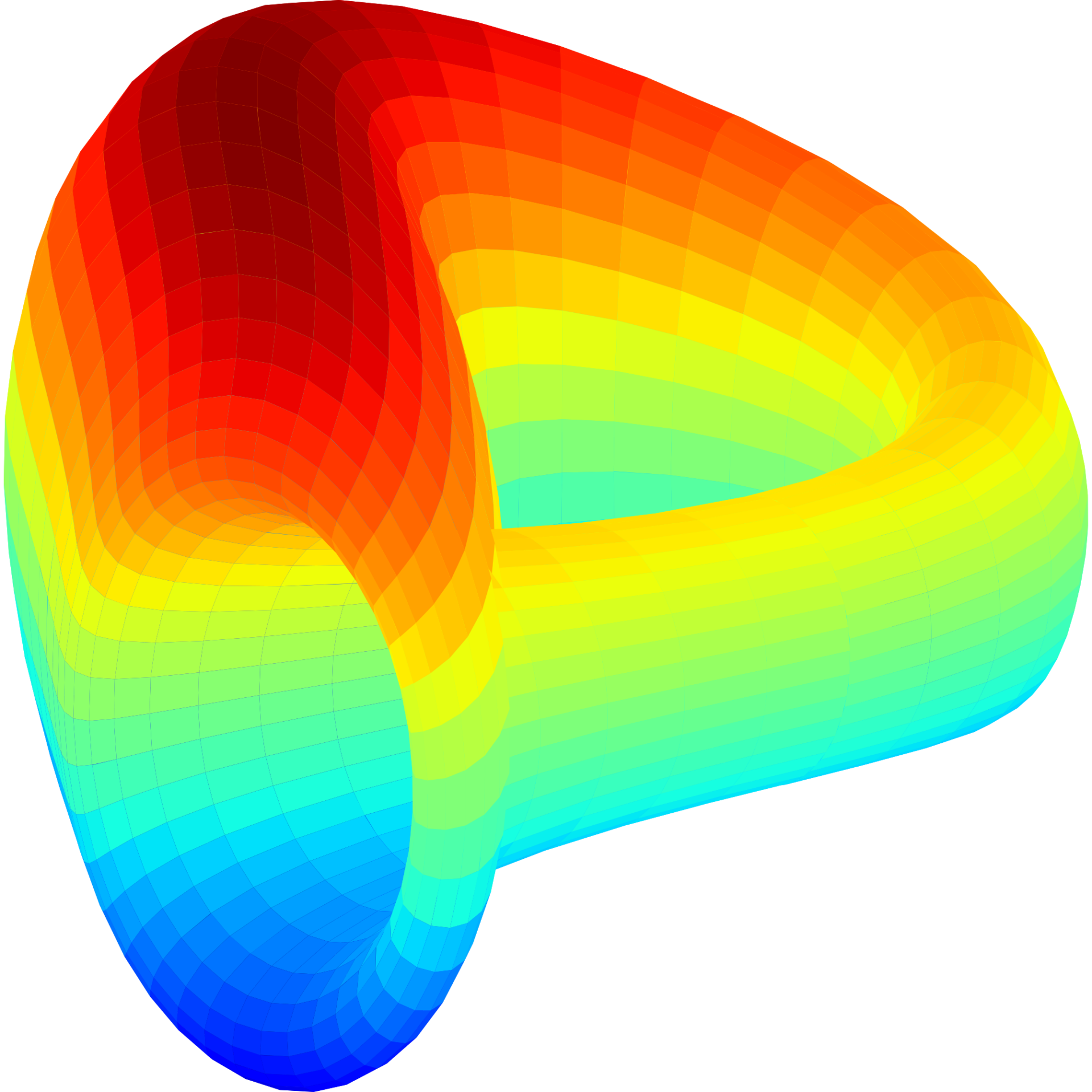

- Curve Finance: Specializing in stablecoin trading, Curve Finance offers minimal trade fees and reduced slippage, making it ideal for stablecoin-related transactions.

Final thoughts

Automated market makers are a vital part of DeFi. They allow people to create markets with great efficiency. While they have limitations compared to traditional exchanges, they bring valuable innovation to the crypto world. AMMs are evolving, with new designs on the horizon. These changes aim to lower fees, reduce issues, and improve liquidity for all DeFi enthusiasts. As DeFi grows, AMMs will continue to shape the future of decentralized finance.